The Reserve Bank of India in its monthly bulletin for November 2020 said that India, for the first time in history, has entered the phase of ‘technical recession’. “The index nowcasts GDP growth at (-) 8.6 per cent in Q2:2020-21, implying that India is likely to have entered a technical recession in the first half of 2020-21 for the first time in its history with two successive quarters of GDP contraction,” said the article titled ‘An Economic Activity Index for India’, which is a part of the bulletin.

The association of the word ‘historic’ with 'technical recession', lead to much hue and cry in the media, social media, and also the public discourse of the country. Let us now try and understand what all these terms mean.

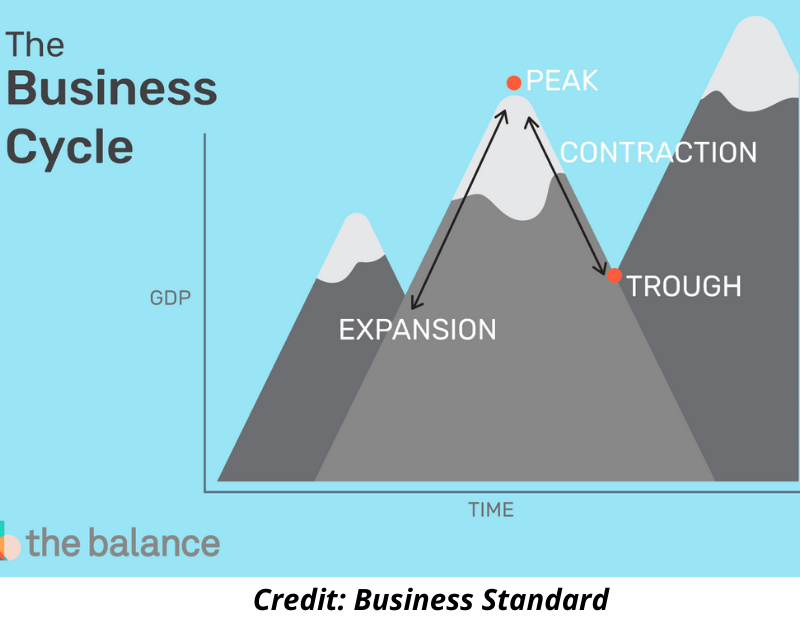

Economies function in a cyclical manner. The sum total of the production activities, along with consumption, demand and supply is called a Business Cycle. It has 4 phases, namely: expansion, peak, contraction, and trough. The expansion phase is marked by upward movement of economic activity, robust production of goods and services, a surge in demand, high rates of employment, and a positive of growth in Gross Domestic Product (GDP). The expansion phase reaches a point called the peak, where the highest ever growth is recorded. The contraction in production and demand for goods and services, an increase in unemployment, and a decline in GDP growth is called contraction, and the lowest point is called a trough.

Economies function in a cyclical manner. The sum total of the production activities, along with consumption, demand and supply is called a Business Cycle. It has 4 phases, namely: expansion, peak, contraction, and trough. The expansion phase is marked by upward movement of economic activity, robust production of goods and services, a surge in demand, high rates of employment, and a positive of growth in Gross Domestic Product (GDP). The expansion phase reaches a point called the peak, where the highest ever growth is recorded. The contraction in production and demand for goods and services, an increase in unemployment, and a decline in GDP growth is called contraction, and the lowest point is called a trough.

What is a recession?

Recession refers to a significant decline in general economic activity in a designated region, over a period of time. Some opine it as a prolonged period of slow and steady declining economic performance, which is reflected in the nation’s GDP over a quarter or more. Some of the crucial indicators of recession are industrial output, employment situation, the real income of the general public, and overall wholesale-retail trade.

There is a general fall in demand as economic activities take a downturn, and inflation remains low coupled with signs of falling further. There is also a hike in the prevalent rate of unemployment, and industries resort to price cuts and other cost-cutting measures to sustain their business.

India's industrial production slumped 8% from a year earlier in August 2020, following a revised 10.8% tumble in the previous month and compared to market expectations of a 7.5% contraction. Output declined for all sectors: manufacturing (-8.6% vs -11.6% in July); mining (-9.8% vs -12.8%); and electricity (-1.8% vs -2.5%). It rose 0.2% over a year earlier in September 2020. As per CMIE, India’s unemployment rate currently stands at 6.98%. Haryana tops the list with 27.3%, while Sikkim has the lowest figure of 0.9%.

What is a technical recession?

When an economy witnesses 2 back to back quarters of decline in economic output, it is termed to be in a phase of technical recession. In other words, when the GDP falls for 2 quarters straight, it is said to be in technical recession. This is exemplified by a fall in the aforementioned indicators of recession: industrial output, employment situation, real income, and wholesale-retail trade.

India and Technical Recession

The Reserve Bank of India, India’s apex bank in its monthly bulletin earlier this month highlighted the fact that India has entered the phase of technical recession. India has seen an unprecedented fall in the GDP over the last 2 quarters and hence entered this phase for the first time in its financial history.

The GDP shrank by a mammoth 23.9% Y-o-Y between April-June, followed by 8.9% between July-September. While most of it could be attributed to the global pandemic of COVID-19, it would be totally wrong to blame the virus for it. Even the performance of India’s economy wasn’t that great in the quarters preceding it, in what is now called the pre-COVID era.

As per the National Statistical Office, the Indian economy grew at 4.2 % in 2019-20, lower than the 6.1 % in 2018-19, marking the lowest GDP growth in 11 years. The signs of a slowdown were evident in the year 2019 when the GDP growth rate slipped for 5 straight quarters. Finance Minister Nirmala Sitharaman had then said that there was a slowdown, but there was no danger of a recession, in a bid to protect the shortcomings of the ruling party when it came to handling the economy. Exactly a year later, we are precisely where she said we wouldn’t be.

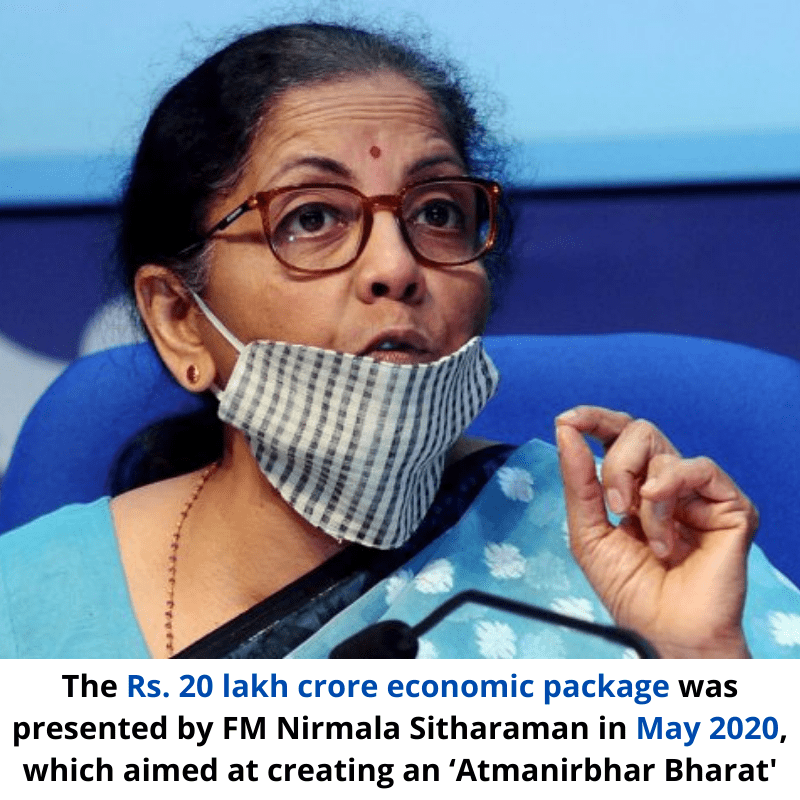

Central Govt did come up with a slew of measures earlier this year, but somehow they fell flat in combating both the virus and the economic after-effects. PM Narendra Modi’s so-called ‘Rs 20 Lakh Crore’ economic package, which was announced in May, couldn’t rescue the economy from escaping the wrath of recession. The nationwide lockdown which put a halt on almost all economic activities, barring the emergency and essential services came as a massive blow to the economy. Countless jobs were lost, both in the organized as well as unorganized sector.

Central Govt did come up with a slew of measures earlier this year, but somehow they fell flat in combating both the virus and the economic after-effects. PM Narendra Modi’s so-called ‘Rs 20 Lakh Crore’ economic package, which was announced in May, couldn’t rescue the economy from escaping the wrath of recession. The nationwide lockdown which put a halt on almost all economic activities, barring the emergency and essential services came as a massive blow to the economy. Countless jobs were lost, both in the organized as well as unorganized sector.

The migrant labour crisis came as an eye-opener of sorts when it came to the way labour was seen and treated in this country. Labour, as a factor of production saw one of its darkest hours when labourers were kicked out of jobs, were rendered penniless, and were forced to walk hundreds of miles back to their homes. This was one of the first signs for the times that were to come and prima facie they were grim. India came face to face with the grim reality when its GDP saw the worst contractions in history.

Almost a quarter of its GDP was wiped out, along with jobs and livelihoods.

The law of demand states that there is an inverse relation between demand and price. The quantity of goods purchased varies inversely with its price; the higher the price, the lower the quantity demanded. Recessions lead to a fall in income. People with lesser disposable incomes had less to purchase. COVID-19 pandemic came as a massive blow to not only our economy, but also to the entire world.

Policy measures for recession

The root cause of a recessionary trend is the lack of demand. Lesser demand leads to lesser production, which leads to the slowing down of the wheels of the economy. It is a vicious circle, which can transform into something fatal if not handled at the right time. Hence, to fix the recessionary trend from a policy perspective, things should be directed towards increasing demand.

The very first step at this could, or rather, should be at increasing the disposable income of the general populace. Disposable income is the amount left after deduction of taxes. The very basic ways of increasing this are either by hiking the base income or by slashing the income tax rate. An increase in disposable income would translate into higher purchasing power, and thus lead to an increase in demand. This should remain at the forefront of the policymakers.

Indirect taxes should also be slashed to bring the prices of goods under control. If produced goods reach the market at a cheaper rate, the demand will go up, and this would help in bringing down the recessionary pressure. Cost control is another effective way of hiking demand, and adjustments to tax rates too can help this cause.

Indirect taxes should also be slashed to bring the prices of goods under control. If produced goods reach the market at a cheaper rate, the demand will go up, and this would help in bringing down the recessionary pressure. Cost control is another effective way of hiking demand, and adjustments to tax rates too can help this cause.

The third policy measure is something that is exercised by the RBI. Under its instruments of credit control, RBI can combat recession by controlling the flow of credit in the economy. The apex bank can slash Bank Rates, Cash Reserve Ratio, and Statutory Lending Ratio and encourage more borrowing, and at much more ease. A fall in the aforementioned rates will lead to banks and other financial institutions lending out money at lower interest rates, and thus encourage lending. This will subsequently lead to more money in the hands of the people, an increase in disposable income, and subsequently an increase in overall demand for goods and services. This measure is also utilized by the RBI to control deflationary trends.

As India battles its first tryst with technical recession, I would like to conclude this piece on a rather optimistic note. There is a glass with some water in it. Let’s leave the age-old binary of half-filled vs half empty. Let us see it as a glass that can be filled, up to the brim if needed. Let us hope the govt, RBI, and the other stakeholders of the economy get their priorities right and take the country out of this mess. I hope the economy bounces back, and we are good to go again. Like we were at one point in time, under the leadership of a certain gentleman to whom history is being really kind lately.

- Akashdeep Baruah

baruah.akashd@gmail.com

(The author is an independent journalist who writes about pop culture, digital media, economy, and other related subjects. He has previously worked with organizations like Reuters and Times Now. Author's portfolio: www.muckrack.com/bforbaruah )

Tags: economics economy recession gdp akashdeep baruah finance Load More Tags

Add Comment